Despite the Fed recently surpassing China as the largest owner of U.S. government debt, the U.S. remains heavily reliant on foreigners to fund the government’s ongoing fiscal largess. Geithner’s Treasury Department has firmly focused new issues at the mid to longer end of the yield curve (since Geithner assumed office, the average length of marketable Treasury debt held publicly has increased by nearly one year). Despite the Treasury taking advantage of the ultra-low interest rate and funding environment, there are substantial refinancing issues over the near term; moreover, many of these maturing issues are foreign owned. Should sovereign fiscal concerns spread to the U.S., in concert with the evermore attractive interest rates offered internationally, refinancing the U.S. debt could become increasingly difficult if foreign investors turn their backs.

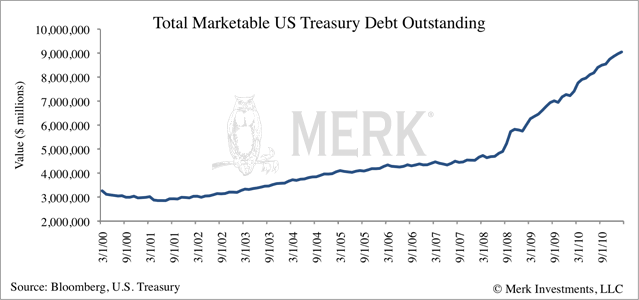

The total outstanding marketable U.S. Treasury debt has expanded considerably recently (total outstanding debt stands at over $14 trillion; marketable debt excludes a substantial portion of intra-governmental holdings). Indeed, through February 28, 2011, total marketable debt increased 22.2% from the year before:

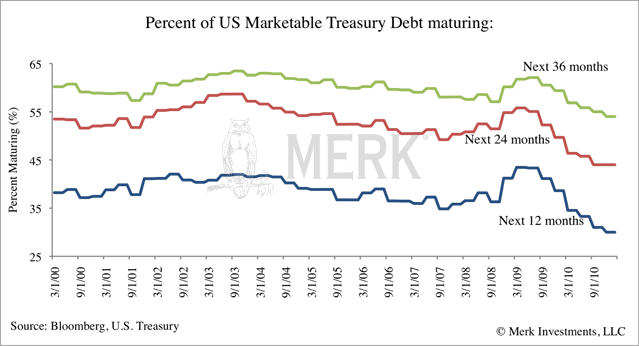

At the same time, much of the new Treasury issuance has been targeted at the middle to long end of the yield curve. The annual change in total marketable Treasury notes (securities issued with maturities of 2 – 10 years) and bonds (securities issued with a maturity of 30 years) through February 28, 2011 was 32.6% and 23.1%, respectively. This trend is evidenced by the decline in the percentage of total marketable debt outstanding that is maturing over the next one, two and three year time periods:

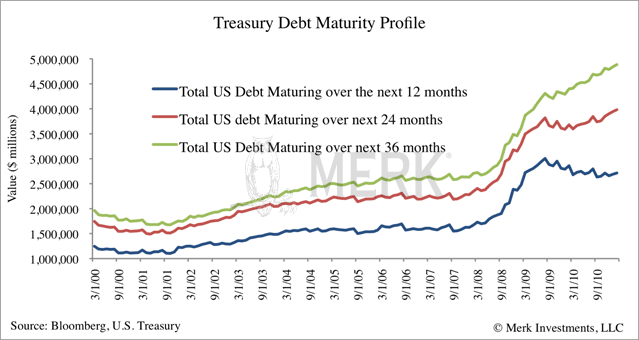

At a glance, the above chart would imply that refinancing pressure may have abated somewhat, but this is not necessarily the case. In fact, total U.S. marketable Treasury debt maturing in the next 12 months has held relatively constant, at historically high levels, while the total debt maturing within two and three years continues to expand.

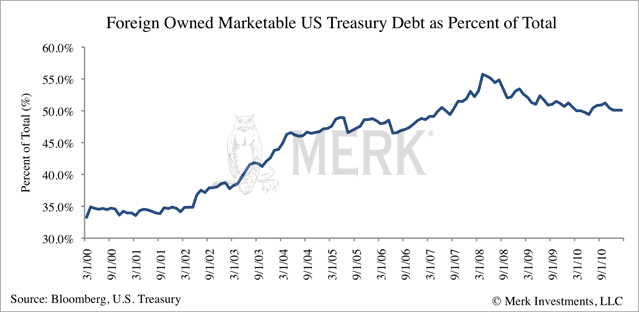

Simultaneously, the percentage of total US marketable Treasury debt owned by foreigners has been trending upwards, albeit experiencing a moderate drop-off recently.

Implying that the overall level of foreign owned US Treasury debt that is maturing in the coming one, two and three years also continues to trend upwards:

To put this in context, over the coming 12 months, the U.S. Treasury must refinance, on average, approximately $5.4 billion dollars in foreign owned debt every single business day. This number doesn’t include any new issuance. Given the U.S. government just posted a record monthly budget gap for February, the substantial fiscal financing requirements aren’t going away anytime soon. Suffice it to say, the US remains highly reliant on foreigners to fund the ongoing elevated levels of government debt and immediate refinancing concerns are apparent, despite recent Treasury issuance targeted at the longer end of the yield curve.

Now consider this: the U.S. fiscal situation has deteriorated significantly; based on numerous metrics of fiscal health, the U.S. is in a relatively worse situation than many of its international peers. Combined with the Fed’s policies of intentionally overvaluing U.S. Treasury securities via quantitative easing policies (as stated above, the Fed is now the largest holder of U.S. government debt; who says the Fed isn’t monetizing the debt?), in the process driving U.S. rates to evermore unattractive levels relative to sovereign debt yields found outside of the U.S. As a result, rational investors may increasingly seek to access less manipulated, more attractive returns in countries that appear much more fiscally sound. We are already seeing this dynamic play out, albeit at the margin. The U.S. dollar weakness is a manifestation of this shift in investor preference. Investors may want to consider positioning themselves accordingly, should these marginal shifts in investor sentiment adjust more rapidly, or grow into a disorderly adjustment, as certain investors and central bankers may fear.