Greek and Portuguese Euro-based sovereign debt yields hit new highs today with the Greek 10-Year sovereign bond yield topping 13% for the first time in the history of the Euro and the Portuguese yield.

Greece 10-Year Yield 13.27%

Portugal 10-Year Yield 8.88%

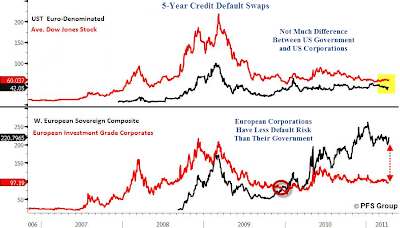

5-Year Credit Default Swaps US vs. Europe

Here is an interesting chart from Chris Puplava at PFS Group (Financial Sense) comparing default risk in the US vs Europe.

Click on chart for sharper image

Note that government default risk is higher than corporate risk in Europe. The opposite is true in the US.

The market clearly believes there is risk of default on Portuguese and Greek government bonds and so do I.