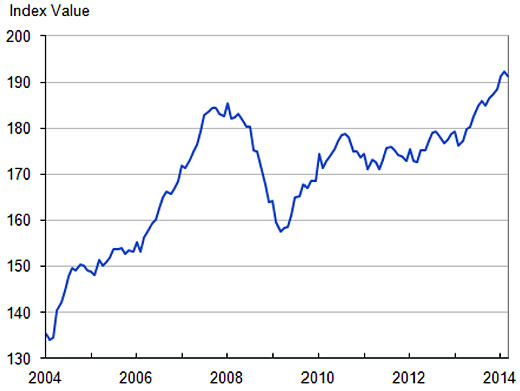

The media and the blogosphere continues to buzz about the risks building in the UK residential housing sector. Just look at this housing price index - we are way above the pre-recession peak. Compare it to home prices in Spain to see this massive divergence (see chart). It's a bubble and it's about to burst...

UK housing price index (source: Office for National Statistics)

Hogwash. As discussed before (see post), the UK is struggling with a housing shortage. Unlike the US and Spain who overbuilt prior to the financial crisis, the UK started the recession with an insufficient housing inventory. And the new supply of homes entering the market remains inadequate. Here is a chart of UK housing starts…

Source: Department for Communities and Local Government

…and here is the UK population over the same period.

Furthermore, there is little evidence of any material speculative investing activity in resi property markets that we saw in the US prior to the crisis. And most importantly there is no evidence of aggressive mortgage lending. In fact the amount of new mortgages approved in the UK is declining this year after last year's increase.

So for all of your folks who are looking for financial bubbles across the globe, this is not one of them. And yes, you hear regulators, IMF officials, and politicians talk about this as being the next scary problem for the UK. In reality however these people are just "fighting the last war".