On January 26, Bloomberg Businessweek printed an editorial by Charles Kenney titled, “Everything You Know About Peak Oil Is Wrong”. This editorial reflects several common misunderstandings.

According to Kenney:

Titled Limits to Growth, their report suggested the world was heading toward economic collapse as it exhausted the natural resources, such as oil and copper, required for economic production. The report forecast that the world would run out of new gold in 2001 and petroleum by 2022, at the latest.

Limits to Growth gives a table that might be interpreted to show that oil and gold new extraction will be exhausted by the dates indicated. The book is careful to explain that the situation is more complicated, though. The way the book summarizes the issue is as a price problem:

Given present resource consumption rates and the projected increase in these rates, the great majority of non-renewable resources will be extremely costly 100 years from now.

In fact, high cost is precisely the issue with oil right now, and we are still ten years away from 2022. A graph of recent crude oil production is shown below. The amount of production has not been able to rise above about 75 million barrels a day (MBD) since 2005. At the same time, price is very high.

Figure 1. World crude oil production has been bumping up against a limit of about 75 million barrels a day (MBD) since 2005, as oil prices have gyrated wildly. (EIA data)

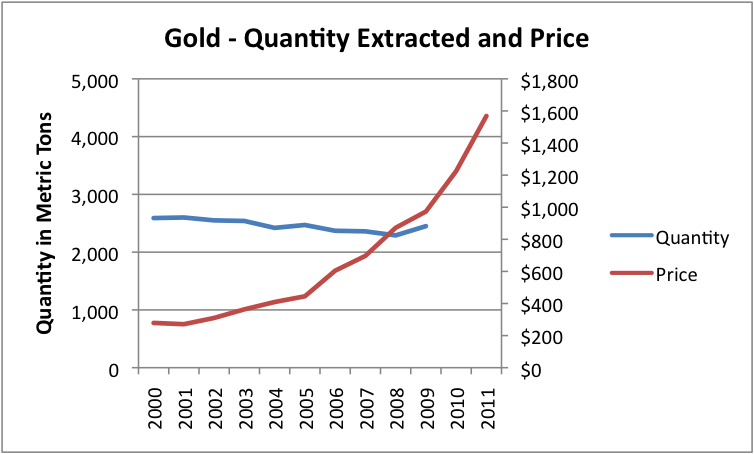

If we look at gold production and prices, it shows pretty much the same story: stalled out production and very high prices.

Figure 2. Gold production has been flat to slightly declining as gold prices soared. Gold production from USGS; Gold Price is from World Bank Commodity Markets Pink Sheet.

The problem is a two-fold problem: it is a price problem, and a problem of not being to increase extraction as much as one would like. The issue is one of declining quality of resources, as lower grade ores are found, and more difficult to extract oil is found. There are plenty of resources available; the issue is that we cannot afford the high cost of extracting them.

Kenney says, “Far from being depleted, worldwide reserves of minerals continue to climb.” He then goes on to list a whole host of resources: natural gas liquids of 1.2 trillion barrels, shale oil of 4.8 trillion barrels, and tar sands of 6 trillion barrels.

These are lower and lower quality resources. In order to make sense for these resources to be extracted, it is important that the cost of extraction not be too high. Many of the large oil importing nations went into recession in 2008-2009 when oil prices climbed to 7 barrel, and quite a few economies are struggling now, with prices in the 0 to 0 barrel range. Unless we can get the oil out at a reasonable price, there is no point in even counting them in the base.

There is also an issue of how quickly resources can be extracted. Canada has been attempting to develop the oil sands since 1967, but even after more than 40 years of attempted development, only 2% of the world’s oil supply is from this source.

Kenney also doesn’t seem to understand that Daniel Yergin is far from an unbiased observer. He says,

And yet according to renowned oil analyst Daniel Yergen [sic], technology advances and new discoveries have allowed oil reserves worldwide to keep growing.

Daniel Yergin is chairman of IHS Cambridge Energy Research Associates and Executive Vice President of IHS. The companies he works for do consulting work for oil companies. These oil companies would like you to think that their prospects for the future are as good as possible. In many ways, Daniel Yergin’s role is not too different from that of Jack Gerard, CEO of the American Petroleum Institute. If a person checks back, one finds that many of Yergin’s rosy predictions have proven false.

Kenney has another overstatement:

New technologies suggest the dawn of U.S. energy independence.

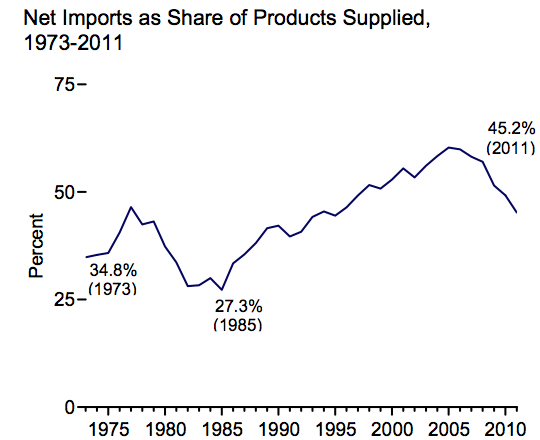

This is flowery language, but doesn’t represent the real situation. A big part of the reason our imports are down in recent years is because US oil consumption is down. People who are laid off from work drive less, and with high oil prices, fewer people take driving vacations or go by airplane. The EIA shows this graph of net imports.

Figure 3. Net imports as percentage of petroleum products supplied--Graph created by EIA. https://www.eia.gov/totalenergy/data/monthly/pdf/sec3_6.pdf

We are still importing 45.2% of “products supplied”. This comparison is on a volume basis, not on an energy basis. If the comparison were on an energy basis, we would be importing over 50% of petroleum products. Biofuels and natural gas liquids, which are lower energy than oil, are treated if they were substituting for oil on a barrel for barrel basis, but they really are not.

We hear a lot about having very low natural gas prices right now, because of higher production of natural gas combined with a warm winter. Unfortunately, having more natural gas doesn’t fix our oil problem. Our oil problem is the fact that price is too high because of inadequate world supply and also because much of the cheap-to-extract oil is already gone. We have had to move on to more expensive-to-extract oil supplies.

Over time, natural gas may make a small dent in our oil problem, if a few vehicles can be converted to natural gas. But the large size of natural gas tanks and lack of refueling stations make them unsuitable for many uses. The amount of natural gas available for substitution also isn’t all that high, relative to the world oil deficit.

Kenney also said:

Limits to Growth suggested the world would be on the verge of complete economic collapse around about now, with industrial output falling to its level of 1900 by the end of this century, as resources vital to sustaining a modern economy dried up. However dire today’s global financial crisis, we are nowhere near such a doomsday scenario.

I would disagree with Kenney on this. He doesn’t seem to see the close connection between high oil prices and the economic problems we are seeing today. With high oil prices, people cut back on discretionary goods, resulting in layoffs among people who work in those industries. For example, fewer people have jobs in vacation industries (for example, in Greece and Spain) if oil prices are high. This leads to recession and debt defaults. If one country defaults, ripple effects can spread to banks around the world.

Our economy has a high level of debt. We need economic growth in order to repay that debt with interest. If oil supply remains flat, or worse yet, falls, it will be difficult to produce the level of economic growth needed to prevent debt defaults.

Hopefully, Kenney will be right about the issue of economic collapse, but it seems to me that the possibility should be a serious concern. Peak oil and the related issue of Limits to Growth are real issues, even if Charles Kenney doesn’t understand them.

This post was written for ASPO-USA’s February 6, 2012, Peak Oil Review.

Source: Our Finite World